As I mentioned in my last post, America is staring down the barrel of an impending financial crisis, and the question is not if, but when we’ll have to eat that bullet, or several of them. Put simply, we have an out of control spending problem with both entitlement programs (Social Security, Medicare, Medicaid, etc.) and national defense. Each of these expenditures are currently at monumental and unsustainable levels, which are going to have to be dealt with eventually. Making matters worse, both of the parties in power, as well as the majority of American citizens, are quite unwilling to look this problem squarely in the eye, let alone do something about it, so the most likely scenario is that rather than solving it before it causes a massive economic crises, everyone will just keep their eyes closed and heads down, hoping to get as much out of it as they personally can until the gravy train runs out.

Neither party is going to do anything about it because as I previously mentioned, Republicans are religiously attached to an infinitely increasing amount of defense spending, and Democrats seem to have the same feelings about entitlements. To Democrats, our problem isn’t that we spend so much on entitlements that we’re careening towards a humiliating national bankruptcy, but that we don’t spend nearly enough on them. To Republicans, there is literally no such concept as “too much defense spending.” It’s a thing that they don’t recognize as existing in the universe. And as bad as Republicans are on defense, Democrats explicitly want to add trillions more to our spending and debt problem by vastly expanding entitlement programs generally and specifically, for example by enacting jaw-dropping expenditures like Medicare For All.

And then of course, there is the fact that neither party wants to upset voters by even talking about taking away or reducing entitlements they’ve grown used to. Which, a conservative would argue, is exactly the problem with too much government and too much reliance on it. It’s also why government can never shrink, only grow: once someone gets used to having something, you can’t take it away from them, at least without incurring a massive political cost which likely amounts to career/party suicide. Liberals count on this whenever they pass new entitlements, such as the ACA for example.

So for the foreseeable future, American voters will continue to force their politicians to keep kicking the can down the road. But something that can’t go on forever, eventually will end. And the longer it goes on, the harder and uglier that end will be.

Earlier I mentioned eating bullets. There are several types of economic bullets we may be forced to eat, and they are all equally unpleasant:

— Massive tax increases (on everyone, not just the wealthy)

— Hyperinflation, as the economic geniuses in our government try to print money to get out of the crisis they’ve created

— Massive austerity, in general and in cuts to the very programs we are so attached to that are taking us down this road

We are definitely going to have to eat one of these, if not some combination of all three. I’ll say a bit about each one.

Tax Increases

One of the core tenets of liberal/left-wing politics is a fundamental belief that we can pay for every single program and entitlement we ever dream of if we only tax “the rich” enough. There are a lot of philosophical and economic problems with this point of view and the overall hostility towards “the rich” on the left, but the one relevant to this particular issue is this: there is simply not enough money in the hands of “the rich” to solve this problem, even if we confiscated every single dollar from every single one of them. The only possible outcome if we rely on tax revenue to balance our budget is a massive tax increase on everyone, from the richest person all the way down to the poorest individual we as a nation decide to tax. What this future looks like is a lot like present-day Europe, with tax rates at 50% and well above, up to 60 and 70% of income, for rich and middle class alike, large value-add taxes (sales taxes) on top of that, and even outright confiscatory taxes on overall wealth, such that a person could be taxed at more than 100% of their income in a given year if they’ve committed the economic sin of being “too rich” overall through the course of their lives. This is a system and an economic view that the left admires and sees as the most virtuous vision for our future, so that is definitely not a philosophical or economic problem as far as they are concerned. Any way that we can be more like “Enlightened Europe” we should, including spending 50-70% of our work hours to pay the government to spend as they, in their infinite wisdom and grace, see fit. This is definitely a debate we should have out in the open, both because I would like to see the left defend this view economically, rather than on the basis of emotional anecdotes about people who could benefit from an infinitely increasing social safety net, and because I don’t believe that they could persuade a majority of Americans to their position, if we discuss it in unemotional economic terms.

Now for an absolutely crystalizing illustration of why tax increases on the rich or in general cannot solve this problem, and proof that we have a spending problem rather than a revenue problem, Tony Robbins has put together one of the most impressive presentations on any subject I’ve ever seen to address our nation’s spending for one fiscal year. I’ll link from where the relevant part of the presentation starts, which runs about 15 minutes, but it’s worth watching the whole 20 minute presentation as well to help grasp the scope of our spending problem.

The bottom line on taxes is that

1. There is no possible tax increase that could even pay for our current annual spending, let alone resolve our long-term debt

2. Any attempt to do so will raise taxes to catastrophic, economy-killing levels

3. Such tax increases will be across the board, not just on “the rich”

Hyperinflation

Benefit cuts/austerity

When unsustainable spending reaches its end, when a ponzi scheme runs out of rubes, when your last check finally bounces…then, at last, you will stop spending, because you are forced to. When we run out of money to spend on these benefits, we will be forced to as well. When that day comes, we will require truly massive reductions in benefits to these programs, and likely other fiscal austerity measures, in order to be able to fund them at all, at any level. To understand why this will be necessary, we need to understand how we got here.

Sometimes it helps to use relatively small, digestible numbers to help us understand trends and patterns that involve bigger numbers or a big problem. So here are a few numbers to help us understand what we’re dealing with in regards to entitlement spending over the next few decades:

— Every day, 10,000 baby boomers turn 65 (about 4 million a year)

— When Social Security was first passed, there were about 42 workers for every beneficiary

— In 1950 there were 16 workers for every beneficiary

— We are now at less than 3 workers for every beneficiary (2.8 in 2016)

— In the next 15-20 years, we are approaching 2 workers for each beneficiary

I hope those numbers hit you hard and give you pause, as they did me. Let’s sit with this for a minute, with a couple of helpful graphs:

Now I’m no mathematicical genius, but to ME, that looks unsustainable. I know intellectuals like to talk a lot about nuance and complexity when it comes to public policy, and certainly understanding every aspect of an issue and crafting specific laws and regulations is a pretty complex and nuanced undertaking. But I prefer to focus on breaking things down to the core facts and fundamental principles, to examine the foundations so that we can actually understand these issues and the big picture reality and problems they represent. Understanding is the first step on the journey to solutions, and that requires breaking things down to their core.

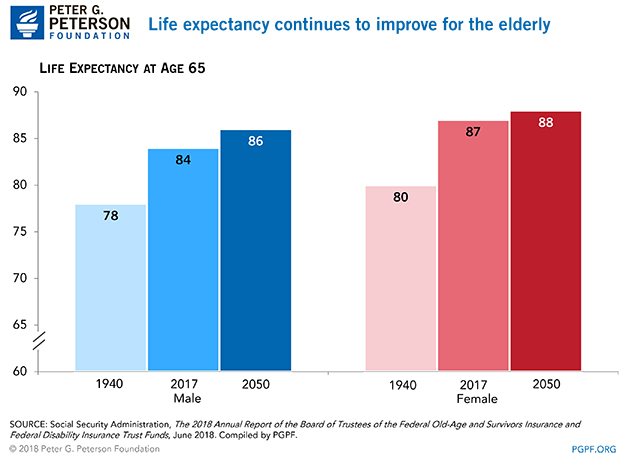

Now I just said I’m not a mathematician, so I can only offer what come to mind as simple, common sense first steps to at least alleviating the stark arithmetical problem above. The first would be to raise the retirement age. When Social Security was first passed in 1935 with a retirement age of 65, the average life expectancy for men was 60 and for women was 64. In 1960 they were 67 and 73, respectively. Even as late as 1980, it was 70 and 77. Now we’re looking at 77 and 81 for average life expectancies.

But, good news for the elderly: it’s even better than that if you make it to retirement age!

The point I’m trying to make, what nobody tells you, is that when social security was first enacted, it was never intended or imagined as a subsidy from the rest of society to live 20 more years without working. It was more like a social welfare benefit you could count on if you struggled to pay your bills in your old age (as defined then), if you could no longer work or had no family that could help take care of you. And even then, it wasn’t intended for you to collect for decades, but for a few short twilight years.

As one analyst noted:

Although “mid-sixties” is typically the age range defined as the beginning of retirement, history shows that until fairly recently, it was common for men to be employed after they reached 65. In 1880, 76 percent of men were employed at age 65, a proportion that declined to 43 percent in 1940, and 18 percent in 1990. Although the current recession has caused more workers to postpone retirement, a 2009 survey of retirees found that 84 percent had entered retirement at age 65 or earlier.

When Social Security was established in 1935, state pension systems were split equally between those that determined 65 as the retirement age and those that determined 70 as the retirement age. The Commission on Economic Security, which designed the system under FDR, was swayed to adopt age 65, partly because the federal Railroad Retirement System, which was established in 1934, used 65, and partly because analyses at the time showed that 65 was actuarially feasible at low levels of taxation [emphasis mine].

Let’s dwell on that last link and point again:

Taking all this into account, the CES planners made a rough judgment that age 65 was probably more reasonable than age 70. This judgment was then confirmed by the actuarial studies. The studies showed that using age 65 produced a manageable system that could easily be made self-sustaining with only modest levels of payroll taxation [emphasis mine].

See, the thing about Social Security, Medicare, or any other social safety net or benefit is that they’re noble, they’re compassionate…and they’re luxuries. These are great institutions and policies for civilized societies and advanced economies to enact…if they can afford them. But it seems like the “if we can afford it” point was lost to history somewhere. Now we decide what we want and cook the books and kick the can to finagle it, rather than figuring out what we can afford and crafting policy from there. Doesn’t that seem kind of backwards, if not outright irresponsible?

And this is how we arrive at our current untenable situation regarding Social Security. We’ve come to view everyone’s individual retirement at 65 as some sort of inherent, god-given right, and the taxpayer subsidy along with it. But rather than an individual retirement plan, doesn’t social security make a lot more sense as a safety net for those who just happen to need financial help in their old age, rather than the economic right of anyone over a certain age to have wealth transferred from younger working people, no matter how well off they may be in old age?

It’s right there in the name: “Social.” “Security.” Doesn’t that sound like a…I don’t know…safety net, rather than a taxpayer funded 20 year vacation? Doesn’t that sound like a plan for a compassionate society to help senior citizens in need, and specifically those in need, rather than the primary source of retirement income for the vast majority of Americans? Especially when you consider how much healthier and active each generation of retirees is than the last, doesn’t it seem reasonable we should expect them, and ourselves, to work longer than previous generations, well past 65?

This isn’t something that can, or should, be done overnight, or sprung on elderly people who have relied on this promise and expected to retire in their 60s for their entire working lives. But it is something that we can phase in, say perhaps raising it one year at a time in five year generational increments, let’s say starting a decade from now (or whenever we get off our asses). The retirement age is currently being incrementally increased to 67, but that is a statutory change enacted 35 years ago, based on obsolete actuarial tables, and before we blew out our debt like a prom dress at a Springsteen concert.

Imagine if we applied the actuarial tables of 1935, the year Social Security was enacted, to today’s retirees. Using the same math, you wouldn’t be eligible for Social Security until you were 82, a year past the average female life expectancy and five years past the average male life expectancy. Does that help clarify how drastically out of proportion our current system is to its original intent, and how different the worker-to-retiree ratio could be?

Now I agree with what you must be thinking, that we are a much more compassionate and civilized society than we were in 1935…and a hell of a lot richer, too. Fair points. But when you understand where we are versus where we came from, and compare the two versions of the same system side-by-side, it helps clarify what’s happening and where we’re headed, and can maybe help us think about what to do about it.

All of which is the $10,000 way of saying “raise the retirement age, Stupid.”

Final point on Social Security: it should be means tested. Again, look at the name. I know this is controversial, and people are emotionally attached to “their” social welfare benefits that they “earned” when they “paid into the system.” Like a lot of harsh truths, this is something that people don’t want to hear, but must be told, and must accept if they wish to avoid economic disaster: we cannot afford Social Security as a program that everyone is entitled to, but only as a safety net for those who need it. This will require some radical rewiring of Americans’ expectations and notions of what Social Security is, which is why reform is just as unlikely to emerge from grass roots public opinion as it is from congress taking the initiative, especially since the one precedes the other.

But like it or not, it is true. Our whole notion of Social Security has to be revamped to be understood as a safety net, or it will not survive, and our economy will, eventually, buckle under its weight.

Here’s a depressing graph to help get the point across:

A couple of anecdotes nicely illustrate my point. A distant relative of mine had a very successful career, and in retirement, received a pension of just over $100,000 annually, which was on top of substantial earnings that allowed him to save for retirement and accumulate assets throughout his life. Can you really justify taxpayers forking over social welfare benefits to him for 20 or 30 years, as some sort of “security” guaranteed by “society?” Wouldn’t it be better to save that money, leaving it in the pockets of today’s workers, who are still building their families, careers, and wealth? Or, if need be, redirected towards individuals truly in need? Whether you’re liberal or conservative, this should be a layup: lower taxes, or more resources going to the truly needy…or both!

On an even more ridiculous level, munch on this, if you will: I have friends at all levels of society, some fairly high. Some of them rub elbows with millionaires and billionaires, and have told me that when they turn 65 and are eligible for Medicare* and Social Security, these guys get super excited about it. I mean, really! They will literally go on about how they just signed up for Medicare, or just received their first Social Security check…like this is the accomplishment they’ve been working towards their whole lives, not their first million or their first billion. What do they do with this lunch money, you may ask (I sure did)? Buy a cheap car to toodle around in at their vacation property. Give it to their grandkids for an allowance, or for spending money in college. Who knows what else. This particular group is a small percentage of retirees, but this extreme example illustrates the principle: it is a ridiculous public policy to spend “social welfare” money on people who have done very well in life. But even these people would most likely fight tooth and nail to defend “their” social welfare that they “earned” when they “paid into it.” You see the problem here…?

What I hope I have conveyed in this section is how dreadfully unsustainable our current approach to retirement benefits is, from an economic standpoint, and a sense of how disastrous the train wreck is going to be if we don’t take some pretty serious steps to restructure our system to avoid it.

*All of my arguments about a means test for Social Security apply to Medicare, and it seems reasonable to assume the worker-to-beneficiary pyramid is the same as it should be the same people

Going back to the beginning, the three pillars that are the foundation of our impending financial meltdown are Social Security, Medicare, and military spending, the latter of which I’ve addressed here.

If we don’t get our spending under control, we are going to have make some very ugly choices, which will most likely include some sort of drastic benefits cuts and austerity measures, in this and other areas of the federal budget. And of course, any plan we devise will be hasty and imperfect, so more than likely a lot of truly needy and deserving elderly people and others will be deprived of needed resources, and our county will betray the promises it made to them in the nastiest bait & switch in modern economic history.

This is the future I want to avoid, but I see absolutely no sign from either our electorate or our elected officials of even admitting these structural problems, let alone doing something about them. I fear it is far more likely that we will have a crippling economic meltdown in our lifetime that will dwarf the housing crisis of 2008. If that should occur, your most pressing concern may not be what will happen to your savings account or your 401k, or whether you’ll be able to afford to send your kid to college. It may be whether you have enough beans and bullets.

And then we will be here:

After serving you all this delicious gloom and doom for your main course, let me offer you some more for dessert. No whine. I want to leave you with a few more things to think about and a few more resources to dig into in order to further your understanding of our economic future.

See, even the depressing facts I mentioned above do not describe the totality of the fiscally irresponsible policies our country is engaged in. Those are just the most costly federal ones. But state governments have their own self-created economic icebergs, and are veering towards them just as fast. Take a few minutes to read this 60 Minutes article from 2010, and you’ll see that our national economic situation is much, much worse than I described above. The article is four pages, here are the first few paragraphs:

By now, just about everyone in the country is aware of the federal deficit problem, but you should know that there is another financial crisis looming involving state and local governments.

It has gotten much less attention because each state has a slightly different story. But in the two years, since the “great recession” wrecked their economies and shriveled their income, the states have collectively spent nearly a half a trillion dollars more than they collected in taxes. There is also a trillion dollar hole in their public pension funds.

The states have been getting by on billions of dollars in federal stimulus funds, but the day of reckoning is at hand. The debt crisis is already making Wall Street nervous, and some believe that it could derail the recovery, cost a million public employees their jobs and require another big bailout package that no one in Washington wants to talk about.

“The most alarming thing about the state issue is the level of complacency,” Meredith Whitney, one of the most respected financial analysts on Wall Street and one of the most influential women in American business, told correspondent Steve Kroft.

Whitney made her reputation by warning that the big banks were in big trouble long before the 2008 collapse. Now, she’s warning about a financial meltdown in state and local governments.

“It has tentacles as wide as anything I’ve seen. I think next to housing this is the single most important issue in the United States, and certainly the largest threat to the U.S. economy,” she told Kroft.

Asked why people aren’t paying attention, Whitney said, “‘Cause they don’t pay attention until they have to.”

Whitney says it’s time to start.

If the written word doesn’t frighten you, then by all means, watch the actual segment for more bone-chilling economic facts that will keep you up at night, wondering how many AR-15s you can buy in the next few years.

Then there was this recent projection by the Congressional Budget Office covered in the Wall Street Journal: the interest alone on our national debt is soon going to surpass even our outsized defense budget.

In 2017, interest costs on federal debt of $263 billion accounted for 6.6% of all government spending and 1.4% of gross domestic product, well below averages of the previous 50 years. The Congressional Budget Office estimates interest spending will rise to $915 billion by 2028, or 13% of all outlays and 3.1% of gross domestic product.

Along that path, the government is expected to pass the following milestones: It will spend more on interest than it spends on Medicaid in 2020; more in 2023 than it spends on national defense; and more in 2025 than it spends on all nondefense discretionary programs combined, from funding for national parks to scientific research, to health care and education, to the court system and infrastructure, according to the CBO.

Debt as a share of gross domestic product is projected to climb over the next decade, from 78% at the end of this year—the highest it has been since the end of World War II—to 96.2% in 2028, according to CBO projections. As the overall size of our debt load grows, so too do the size of interest payments.

Ben Shapiro mentioned this impending financial crisis in a recent show, and discusses the terrifying worst case scenario at 22:30 – 26:17 below.

Last but not least, this article is one of the best resources on this issue. It’s short, digestible, and discussed in layman’s terms.

https://www.smh.com.au/business/us-is-bankrupt-and-we-dont-even-know-it-20100812-12056.htmlI

If you prefer your depressing information to be conveyed verbally, most of the text is included in the video description below.

Phrase of the Day, kids: unfunded liabilities

Note: if you want to watch the embedded videos from the start time I recommend, you have to click on the embedded version and watch it on this page. Clicking it into a new tab will take you to the video from the beginning, I just learned that. They are extremely enlightening, so I encourage you do check them out if you can. If you can’t now, you can bookmark them for later or return to this post and watch them later.

If you liked this article, please subscribe to my blog by clicking the blue “Follow” button in the upper right corner (at the bottom of the article if you’re on your phone or tablet) to receive an email every time I post, which isn’t that often. And of course feel free to share it if you know someone else who may enjoy it.

Also: If you like what you see here, you can also follow my Facebook page, where I post more ground-breaking articles from other people rather than just my own work, and my Twitter page, where I just tweet.

So I agree we need to raise the retirement age for Social Security. Also probably we need to consider increases in capital gains taxes after a certain wealth point, though not to the extremes of the far leftists, and we need to reduce military spending. But one thing that I don’t think you consider is that medicare for all is not intrinsically expensive if we were to do a better job, like Europe, of regulating medical costs. We already spend more in taxes per capita for medicare/medicaid that only covers the old and poor in our country (so a fraction of the people) than the UK, Australia, Germany and Canada spend on their ENTIRE national healthcare system. Let me say that again, we already spend more in taxes per capita than most countries who are funding everyone on their entire healthcare system. So that is not why European tax rates are higher. Full stop. Our healthcare costs are too high, for many reasons, not just one, and those need to be addressed first. Here is good video on exactly what is costing more in our system: https://www.youtube.com/watch?v=qSjGouBmo0M

LikeLike

Well Medicare/Medicaid costs *are* currently eating up too much of our budget, and at the current rate will indeed be one of a handful of factors that bankrupt us. I don’t disagree that our health care costs could be lower, but that’s its own in-depth discussion.

And the first thing I’d have to ask regarding our medical tax expenditures being higher per capita is *what* we cover vs other countries. What do we pay for “only for the old and poor” that other countries don’t? Perhaps we should stop covering certain things, like certain expensive pre-existing conditions, as they do in other countries? Or ration them, as they do in other countries?

We definitely need to address the costs, that’s an important issue to dive into, but the fact is it’s bankrupting us the way we do it right now, and we need to massively reform/reduce that to save ourselves. A means test might not do much, but it would be a good start.

LikeLike

Also a point to consider is most wealthy countries spend 21% or so of GDP on social services. US, UK, Canada, Germany, Switzerland, the Netherlands etc, all pretty tight around that percentage. It’s not as variable as you might think. And that is removing the military portion of the puzzle. They just get more out of their programs than we do, again consider we spend more in taxes already for healthcare and don’t get free access whereas other countries run their entire healthcare budget on it. http://www.oecd.org/els/soc/OECD2016-Social-Expenditure-Update.pdf

Anyway, great overview though I think you cover a lot of interesting points.

LikeLike

Great, I’ll bite…why are their taxes so high then? What do they spend it on? It’s illogical to say “they get more out of them” when they tax people way more.

LikeLike

Everything the government regulates experiences high inflation rates and everything they don’t regulate drops in price while increasing in quality. Healthcare is no exception, as demonstrated by the subsectors of cosmetic surgery and Lasik which escape the onerous regulations of the rest of the industry. And even that heavily regulated part has more free-market elements than the socialist systems of Europe, which is why most of the innovation occurs here, which then subsidizes those European markets who nationalize what our quasi-capitalists have created. The answer to providing health care for all involves making it cheap and abundant, not killing the goose and redistributing the remaining golden eggs. Poor people aren’t mostly obese because a government program deemed food a “right” and redistributed it via heavy regulation, but because the free market made it cheap and abundant (and yes, even that industry is regulated, which is why there’s an obesity/metabolic syndrome problem, but much less so than health care).

But I know we won’t figure it out, because smart people tend towards planning, and evil people tend towards politics, so we’ll just doggedly pursue “perfect planning by angels” until the collapse. But I’ll at least be able to point to posts like this and say “I told you so”.

LikeLike

That was me above, didn’t realize it would post as “anonymous”

LikeLike